As a Toronto real estate developer, I spend my days navigating a labyrinth of zoning regulations, competitive bidding wars, and the eternal optimism that the next big project will finally not run over budget (spoiler: it will). But today, let’s step away from the construction dust and talk about the real hot topic: the Canadian real estate market, why it’s an unmitigated disaster, and why I’m intrigued by the idea of Canada joining the United States. Yes, I said it. Let’s dive in.

A Quick Recap of the Canadian Real Estate Circus

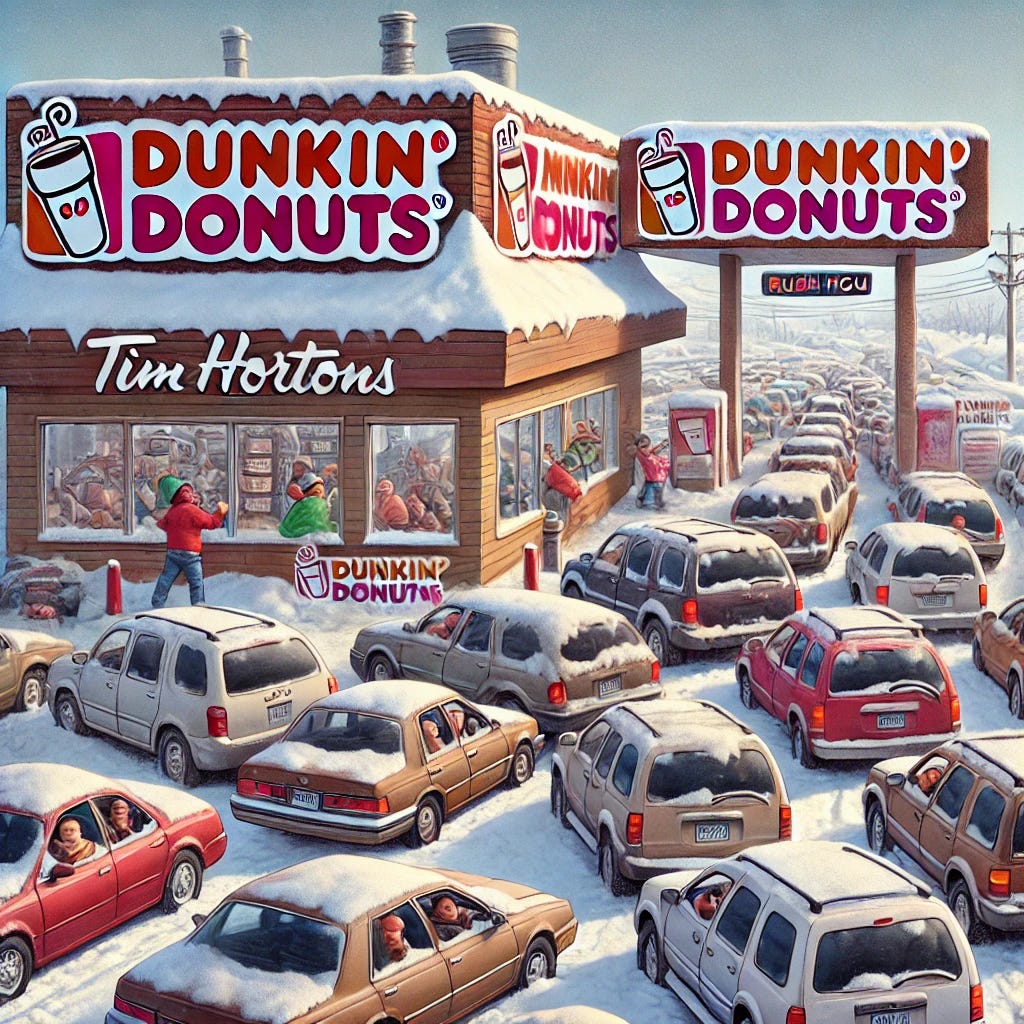

The Canadian real estate market is like a Tim Hortons (or should I say future Dunkin’ Donuts?) drive-thru at 8 a.m.—chaotic, overpriced, and yet, everyone wants in. Or at least they did. Now, the market is starting to feel more like that stale box of Timbits at the end of the day: overpriced and no one wants it. Condos, in particular, have hit a wall. No matter how much granite countertop you slap on or how many rooftop patios you promise, they’re just not moving.

Toronto’s condo market has gone from red-hot to ice-cold. Units that would have sparked bidding wars just a couple of years ago are now languishing on the market like forgotten leftovers in the back of the fridge. And let’s not even talk about the suburbs. Prices are softening, sellers are panicking, and developers like me? Well, let’s just say we’re reevaluating our life choices.

Challenges: It’s Not All Maple Syrup and Hockey Games

Now, let’s talk challenges. Because despite the frothy market of yesteryear, real estate in Canada isn’t just a walk in High Park. For one, there’s the government. Oh, the government. Between interest rate hikes, mortgage stress tests, and enough red tape to gift-wrap the CN Tower, it’s a wonder anything gets built at all.

Then there’s affordability—or the lack thereof. We’ve reached a point where buying a home in Toronto feels about as achievable as winning the Stanley Cup (sorry, Leafs fans). And don’t even get me started on the rental market. $2,500 a month for a one-bedroom with a "partial lake view" (translation: you can see Lake Ontario if you stand on a chair and lean out the window)? Bargain.

And let’s not forget the environmental push. Don’t get me wrong, sustainability is crucial. But when the city asks you to add green roofs, electric vehicle charging stations, and a unicorn stable to every new project, it starts to feel a bit… excessive.

The Shift to Purpose-Built Rentals

Despite the madness, developers are rethinking their projects entirely. The focus is shifting toward building purpose-built rental buildings, a response to the demand for more affordable and flexible housing options. These projects cater to long-term renters and aim to address the growing rental crisis in cities like Toronto.

With condos sitting unsold and buyers growing wary, purpose-built rentals are emerging as a practical solution for developers and a lifeline for renters. It’s a shift that signals adaptability in a market that’s anything but predictable. Developers are banking on the idea that offering stable, high-quality rental options will not only fill a void but also create a sustainable revenue stream in the long run.

The Donald Trump "Annex Canada" Theory

Now, let’s address the elephant in the room—or should I say, the orange-hued elephant south of the border. I’ll admit it: I love Donald Trump. Say what you want about the man, but he knows how to make waves. And his rumored idea of annexing Canada? Intriguing, to say the least.

Think about it. The U.S. could bring some of its go-getter energy north of the border, and we’d finally have a shot at fixing this real estate disaster. No more stress tests, no more endless red tape, and maybe—just maybe—a little bit of that "Make Real Estate Great Again" magic could rub off on us.

But what would actually happen to Canadian real estate if Canada became part of the USA? For starters, we’d likely see an immediate influx of American capital flooding the market. Think higher demand, bigger players, and faster-paced development. American-style suburban sprawl could expand overnight, while urban centers might adopt their southern cousins’ appetite for rapid high-rise construction. On the flip side, the current "affordability crisis" could turn into an outright affordability apocalypse as U.S. investors snap up properties with their deeper pockets.

We’d also likely see regulatory changes. Goodbye, endless zoning meetings with neighbors ranting about shadow studies and traffic. Goodbye, rental replacement policies that eat up time and budgets. Goodbye, mandatory heritage preservation rules that force us to Frankenstein new, modern structures around crumbling century-old buildings just to appease the local nostalgia crowd. Developers could finally focus on creating cohesive, practical designs instead of architectural compromises.

On top of that, we’d likely attract a wave of skilled labor from the U.S. The merging of economies could open up the borders for more construction workers, engineers, and architects. With a larger labor pool and lower costs, large-scale developments could become more feasible, which might finally allow us to address housing shortages at a meaningful scale.

And what about rent controls? Many U.S. states don’t impose them, which means Canadian renters could see significant hikes as landlords seize the opportunity to align with market rates. The rental market might become a no-holds-barred free-for-all, pricing out many tenants who are already hanging by a thread.

Beyond affordability, foreign investment rules could also be relaxed, opening the floodgates for international buyers. While this could boost short-term capital flow, it would undoubtedly squeeze out local buyers and further exacerbate inequality. Plus, let’s not ignore the possibility of turning Canada’s picturesque lakefronts and mountain regions into hotbeds of luxury developments for American vacationers.

There’s also the cultural impact. Could we see Canadian cities adopting more "Americanized" aesthetics, with sprawling strip malls and cookie-cutter suburban homes dominating the landscape? Would our iconic architectural diversity give way to a more uniform, profit-driven design ethos? Developers may find themselves catering less to local needs and more to the demands of wealthy out-of-towners.

However, some benefits could emerge. A stronger economy from increased integration could fund more robust infrastructure, potentially improving transit systems and accessibility to affordable housing. State-like competition between provinces could lead to innovative housing policies, albeit with varied success.

Final Thoughts: Welcome to the Circus

If you’re navigating the Canadian real estate market, whether as a buyer, seller, investor, or developer, one thing’s for sure: It’s a wild ride. The highs are exhilarating, the lows are humbling, and the middle? Well, the middle is just a lot of paperwork.

So, what does this do to prices here in Canada (because that’s what every home and property owner really wants to know)? Who the hell knows.

So, grab your hard hat, pour yourself a double-double, and dive in. Just remember: in this market, the only thing more valuable than a prime location is a sense of humor. And maybe a good lawyer. Cheers!