Raising Equity for a Development Project

Raising equity for a real estate redevelopment deal can be a daunting task, but it is critical to the success of the project. Without sufficient capital, a real estate redevelopment project may never get off the ground. In this article, we will discuss some best practices to help you raise equity for your real estate redevelopment deal.

Develop a solid business plan

The first step in raising equity for a real estate redevelopment project is to develop a solid business plan. Your business plan should clearly outline your project's objectives, the market demand, and potential profitability. It should also highlight the project's unique features that differentiate it from other projects in the market. Investors will want to see that you have a well-thought-out plan and a clear strategy for executing it.

Identify potential investors

Once you have a solid business plan, the next step is to identify potential investors. Start by creating a list of potential investors that might be interested in your project. This could include high net worth individuals, family offices, private equity firms, and real estate investment trusts (REITs). You can also consider crowdfunding platforms as a means of raising equity. Ensure that the investors you target align with the project's investment objectives, size, and structure.

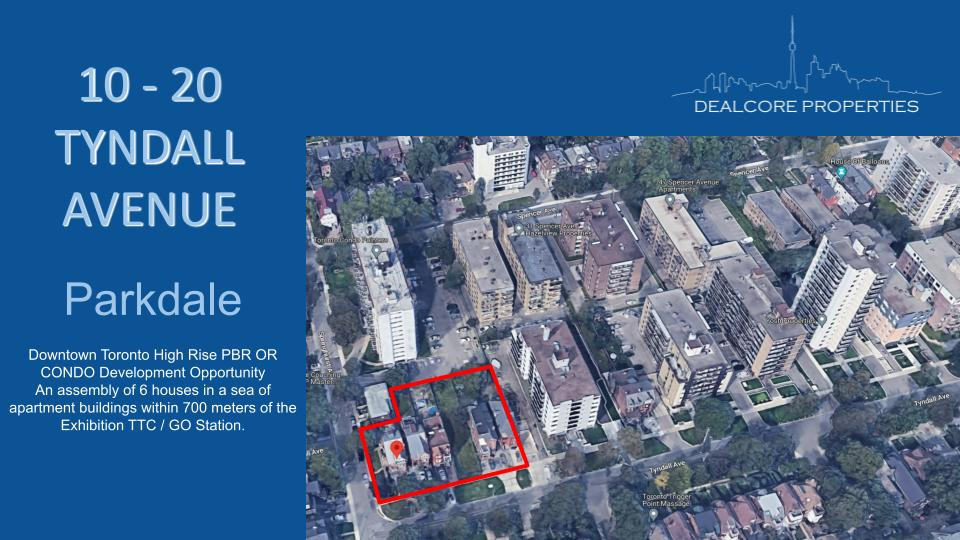

Prepare a pitch deck

A pitch deck is a visual presentation that provides investors with an overview of your project. It should include your business plan, market research, financial projections, and the investment opportunity. Your pitch deck should be clear, concise, and visually appealing. It should be able to convey the project's value proposition effectively.

Be transparent and responsive

Investors want to work with trustworthy and responsive developers. Therefore, it is essential to be transparent and responsive throughout the fundraising process. Be open to answering any questions investors might have and provide regular updates on the project's progress. The more transparent and responsive you are, the more confident investors will be in your ability to execute the project successfully.

Offer attractive terms

Investors will want to see that their investment will yield a return. To attract investors, offer attractive terms that align with their investment objectives. This could include offering preferred returns, equity kickers, or profit-sharing structures. Ensure that your terms are competitive and that they reflect the project's risk and potential return.

Raising equity for a real estate redevelopment project can be challenging, but with the right approach, it can be done successfully. Developing a solid business plan, identifying potential investors, preparing a pitch deck, being transparent and responsive, and offering attractive terms are essential best practices for raising equity. By following these best practices, you can increase your chances of raising the capital you need to execute your project successfully.